Calculating Property Taxes

Mill Levy Also Called Millage Tax

Property taxes are calculated based on the market value of a property. The market value consists of two components, the land value and the building value or the value of improvements. Typically, tax assessors will value a property every three years, and charge the owner-of-record the appropriate rate following the standards set by the taxing authority. Assessors calculate that value using the mill levy–also called the millage tax–and the assessed property value, which is based upon prevailing local real estate market conditions. Illinois complicates the tax calculation by applying an equalization factor that figures the final tax rate up or down. In Illinois, some counties are reassessed every 3 years and some every 4 years.

The mill levy is the tax rate levied on a property based on its assessed value, with one mill representing one-tenth of one cent. So, for $1,000 of assessed property value, one mill would be equal to $1. Tax levy, or the total revenue from taxes each jurisdiction needs to fund its budget, is calculated separately for each tax jurisdiction in an area. Then, all the levies are added together to determine the total mill rate for an entire region. This is done by dividing the total tax levy by the total assessment of all properties in a target area. Generally, every city, county, and school district each has the power to levy taxes against real properties within their boundaries. Taxes are not levied against personal property.

Equalization Factor

An equalization factor is a multiplier used to ensure that the total equalized assessed value (EAV) of property in all counties in Illinois equals 33⅓% of the fair market value. To fairly implement certain state statutes, the State of Illinois Department of Revenue (IDOR) calculates an equalization factor for each county by looking at multi-year comparisons of property assessments and sales prices. It uses this assessment/sales ratio study to calculate a three-year adjusted average for the countywide median ratio, which is then weighted by class of property. This is the equalization factor. This is especially important in Cook County, which differs from the other 101 counties in Illinois in how it classifies and assesses different types of property, i.e., commercial, industrial and residential, at varying levels set in the county ordinance.

Assessed Value

The assessor will review all relevant information surrounding a property to estimate its overall market value. To make the most accurate assessment, the assessor must look at how much comparable properties are selling for under the current market conditions, (also referred to as comps), how much the replacement costs for the property would be, the maintenance costs for the property owner, any improvements that have been completed, any income the owner is making from the property, and how much interest would be charged to purchase or construct a comparable property. The assessor can estimate the market value of a property using three different methods, and they have the option of choosing a single one or any combination of the three.

1. Performing a Sales Evaluation

The assessor values a property using comparable sales in the area. Criteria include location, the state of the property, any improvements made, and the overall market conditions. The assessor then makes adjustments in the figures to show specific changes to the property, such as new additions and renovations.

2. The Cost Method

This is when the assessor determines a property’s value based on how much it would cost to replace it. If the property is older, assessors determine the amount of depreciation that has taken place and how much the property would be worth if it were empty. For newer properties, the assessor deducts any realistic depreciation and looks at the costs of building materials and labor, including these figures in the final value of the property.

3. The Income Method

This method is based on how much income a person could make from a property if it were rented. Using the income method approach, the assessor considers the costs of maintaining the property, managing the property, insurance, and taxes, as well as the return one could reasonably anticipate from the property.

After determining the market value of a property, the assessed value will be determined by taking its actual value and multiplying it by an assessment rate. That rate is a uniform percentage, which varies by tax jurisdiction and is based on the property’s classification. It could be any percentage below 100%.

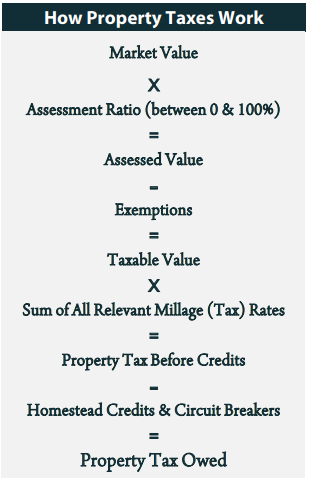

How Property Taxes Are Calculated

An individual’s property tax bill actually starts with how much the county, municipality, and taxing districts (school district, park district, library district, etc.) expect to spend. The various taxing bodies figure out their budget based on the prior year’s budget, plus an annual increase. They then figure out how much money they can expect from the state and assess the current taxable value of the property in the districts, and then the county clerk figures out the tax rate. The county clerk calculates the tax rate based on the amount that the taxing districts are allowed to receive reconciled with the assessed property value.

Once the property’s tax assessment, equalization factor, and the local tax rate are known for any given area, the County’s Treasurer uses that information in conjunction with each property’s exemptions to calculate the final tax amount for each property for a given tax year. This tax amount is simply:

Property taxes and their calculations can be confusing. Always remember, if you are not in agreement with your property tax, assessed value, or tax rate you can always appeal. Consider contacting an attorney that specializes in property taxes to ask how to file an appeal or seek specialized advice.